-

What are Corporate Actions?

Corporate actions are events created by corporate, which impact the share holders. They take place whenever changes are made to the capital structure or financial position of a company that will affect the securities it has issued. It is a process that will bring in a change to securities either in terms of number of shares in the hands of the shareholders or a change to the face value of the security and price of the security.

- Corporate actions are classified into two main categories - cash and non cash corporate actions

- Cash corporate actions results in investors getting benefits in the form of cash such as Interest, Dividend etc.,

- Non - cash corporate action results in the investors getting benefit in the form of securities such as Bonus, Rights, Stock Split etc.

-

What is meant by Dividend?

Dividend is distribution of part of company ’ s earnings to its shareholders usually given twice a year in the form of a an interim dividend and a final dividend. Dividend is therefore a source of income for the shareholders. Generally, dividend is expressed as a percentage of Face Value. This makes it easy to see how much of the company ’ s profit are being paid out and how much is retained by the company to plough back in the business. Board of Directors of a company have discretion as to how much of a dividend should be paid to its shareholders.

-

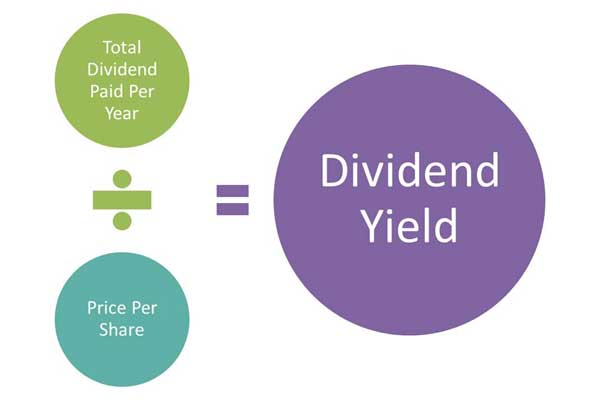

What is meant by Dividend yield?

Dividend yield gives us the relationship between the dividend paid by the company and the current price of a stock.

Example

- ABC Co.Share price: Rs. 360

- Annual dividend: Rs. 10

- Dividend yield: 2.77% (10/360*100)

Here the income we earn out of investing into a particular financial instrument is 2.77% over a period of one year. To receive an income of Rs 10 per year you have to be a shareholder of the company, and for that you have to purchase the share at a cost of Rs 360.

-

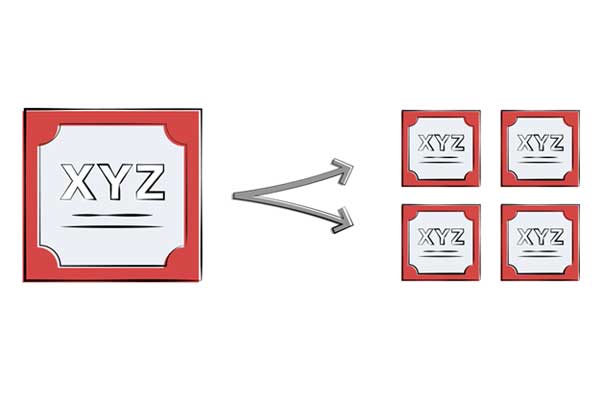

What is a Stock-Split?

A stock split is a corporate action which splits the existing shares of a particular face value into a smaller denominations so that the number of shares increases, however, the market capitalization or the value of shares held by the investors post split remains the same as that before the split.

-

What is Buyback of Shares?

A buyback can be seen as a method for company to invest in itself by buying shares from other investors in the market. It is done by the company with the purpose to improve liquidity in its shares and enhance the shareholders wealth. Usually, a buyback price is higher than the prevailing market price. Under the SEBI (Buy Back of Securities) Regulation 1998, a company is permitted to buy back its share from:

- Existing shareholders on a proportionate basis through the offer document.

- Open market through stock exchanges using book building process.

-

What is a Rights issue?

A rights issue is an invitation to existing shareholders to purchase additional new shares in the company. More specifically, this type of issue gives existing shareholders securities called rights, which will give the shareholders the right to purchase new shares at a discount to the market price on a stated future date. For example, 1:4 rights issue means an existing investor can buy one extra share for every four shares already held.

-

What is a Bonus issue?

A bonus issue is an offer of free additional shares to existing shareholders; a company may decide to distribute further shares as an alternative to increasing the dividend payout i.e. new shares are issued to shareholders in proportion to their holdings. For example, a company may give 1 bonus share for every 5 shares held.

-

What is Merger and Acquisition?

A merger occurs when two or more companies combine into one while all parties involved mutually agree to the terms of the merger. Similarly, in the case of an acquisition, however, a company seeks out and buys a majority of stake in another company; the shares are not swapped or merged.

Previous

Previous- Next

- /

- Take Test

-

Total Questions

10 -

Passing Marks

5 -

Total Time Allotted

Min -

Time Remaining

- Previous

- Next

- Submit Exam