-

What do you mean by Secondary market?

Once the new securities are issued in the primary market they are traded in the secondary market. Secondary market transactions are referred to trades where one investor buys shares from another investor at the prevailing market price or at whatever price the two parties agree upon. Generally, secondary market comprises of equity and debt markets.

The secondary market operates through two mediums, namely, over the counter (OTC) market and Exchange traded market.

- Over the counter market (OTC) ‐ OTC markets are informal markets where trades are negotiated. It is bi-lateral contract, in which two parties agree on how a particular trade or agreement is to be settled in the future.

- Exchange traded market ‐ It is a market place where buyers and sellers come at a place and announce the rate at which they are willing to sell or buy securities.

S.No Exchange Traded Market Over the Counter Market (OTC) 1 Traded in an organized centralized exchange Privately negotiated and have no centralized trading facility. 2 Exchange is the counter party to all the trades The parties involved in negotiations or the trading firms are the counter parties. 3 Highly regulated and hence less counter party risk. Unregulated and involves substantial counter party risk. 4 The exchange traded market involves less price competition and hence higher transaction execution cost for the trading. OTC promotes heavy competition between counter parties and hence lower transaction execution costs.

-

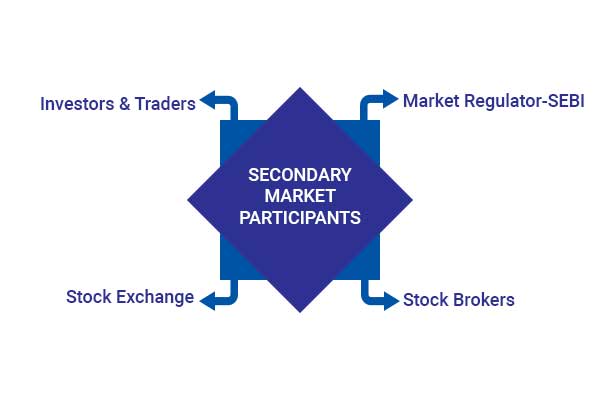

Market participants in Secondary Market:

There are basically three parties to a transaction in secondary market. They are buyers, intermediaries and sellers:

- Buyers and sellers include individual retail investors, High net worth individuals (HNIs), institutional investors such as mutual funds, banks, insurance companies and foreign institutional investors (FIIs).

- Intermediaries are stockbrokers, depositories, and banks that facilitate the movement of securities and money in secondary market transactions.

-

What is the role of the Secondary Market?

For the investor, secondary market provides an efficient platform for price discovery and liquidity i.e. the investors desire to tie up his or her money for a long period of time.

-

Stock exchanges:

The stock exchanges provide a trading platform whereby the buyers and sellers can transact in securities. Like any other market, this is where the price of an equity share gets decided upon on an on-going basis, depending on the demand and supply and prevailing emotions of all the buyers and sellers. Stock exchange could be a regional stock exchange whose area of operation/jurisdiction is specified at the time of its recognition or national exchanges, which are permitted to have nationwide trading. Currently, there are 20 stock exchanges in India, out of which the two largest exchanges in India are the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Stock exchanges in India Ahmedabad Stock Exchange Ltd Interconnected Stock Exchange of India Ltd Bangalore Stock Exchange Ltd Jaipur Stock Exchange Ltd Bhubaneswar Stock Exchange Ltd Ludhiana Stock Exchange Ltd Bombay Stock Exchange Ltd. (BSE) Madhya Pradesh Stock Exchange Ltd Calcutta Stock Exchange Association Ltd Madras Stock Exchange Ltd. Cochin Stock Exchange Ltd MCX Stock Exchange Ltd Delhi Stock Exchange Ltd National Stock Exchange of India Ltd (NSE) Gauhati Stock Exchange Ltd OTC Exchange of India Pune Stock Exchange Ltd Uttar Pradesh Stock Exchange Association Ltd

-

What are Indices?

Among the stocks listed on the exchange, some stocks are selected and grouped together to form an index. This classification may be done on the basis of the industry the companies belong to, the size of the company, market capitalization or some other basis. For example, the BSE Sensex is an index consisting of 30 stocks. Similarly, the BSE 500 is an index consisting of 500 stocks.

The values of the grouped stocks are used to calculate the value of the index. Any change in the price of the stocks leads to a change in the index value. An index represents the behaviour of the changes in the market.

Some of the important indices in India are:

- Benchmark indices ‐ BSE Sensex and NSE Nifty

- Sectoral indices - BSE Bankex and CNX IT

- Market capitalization based indices - BSE Smallcap and BSE Midcap

- Broad-market indices - BSE 100 and BSE 500

-

How can one invest in equity shares?

An investor may either subscribe to public issues made by the companies in the primary market, or by purchasing the shares from secondary market.

-

What are the products available in case of Equity markets?

Delivery

In this type of trading the investors will have to pay the full price of the stock and then stocks are deposited in the demat account.

- 100% capital is required in case of delivery based trading.

- There is no predefined time limit in delivery based trading.

- Settlement happens in T+1 (cash debit) and T+2 (shares credit) where T is the day of the transaction.

- For example, if a client wants to buy 100 shares of Reliance at current market price of Rs. 1000, he will require Rs. 100000 cash to be paid in full amount.

- Trading market hour in case of delivery is from 9:15 am to 3:30 pm.

- Brokerage applicable for delivery segment would be between 0.30% to 0.50%

-

What are the products available in case of Equity markets?

Intraday

If you buy and sell shares in a single day then the type of trading is called as intraday trading.

- Margin trading is allowed in case of intraday segment, buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy more stock than you'd be able to normally i.e. the broker gives you an exposure on the basis of such margin.

- Client’s gets an exposure in intraday, depending upon the VAR (value at risk) percentage of the stock in which he is interested to trade and cash balance is available. No of times exposure is available ‐ VAR multiple = 100/VAR %.

- All the shares you brought with the intraday option should be squared off 3:10 pm.

- Brokerage charges applicable for intraday segment are 0.03% to 0.05% of turnover.

-

What are the products available in case of Equity markets?

Short selling

When an investor sells shares that he does not own at the time of selling is called as short selling. He sells them in the hope that the price of those shares will decline, and he will profit by buying back those shares at a lower price.

- Short selling is permitted only in the case of intraday or the client has to deliver the shares in case he doesn’t buy it before the end of the day.

- For example, if an investor thinks that Infosys stock is overvalued, he sells short of 100 shares at Rs. 1040 per share and if the stock price falls by Rs. 1035 per share, he will buy back 100 shares of Infosys and closes out the short sale. He will gain the difference between the sales proceeds and the purchase costs and pockets Rs. 800 from the short sale, excluding transaction costs.

- In case of short selling brokerage is charged as per intraday i.e. 0.03% to 0.05%.

-

What are the products available in case of Equity markets?

Buy Today and Sell Tomorrow (BTST)

It is a part of delivery product. Usually, you sell shares after you get the delivery of shares to your demat account. But in the case of BTST you buy shares today and sell them the next day before taking the delivery.

- The brokerage charged is same as in the case of delivery i.e. 0.30% to 0.50%.

- In case of BTST shares are to be sold before T+2 settlement cycle.

- For example, an investor has bought 100 shares of Infosys in delivery then the client can sell the same shares in BTST that is same quantity or less than that before taking the delivery.

-

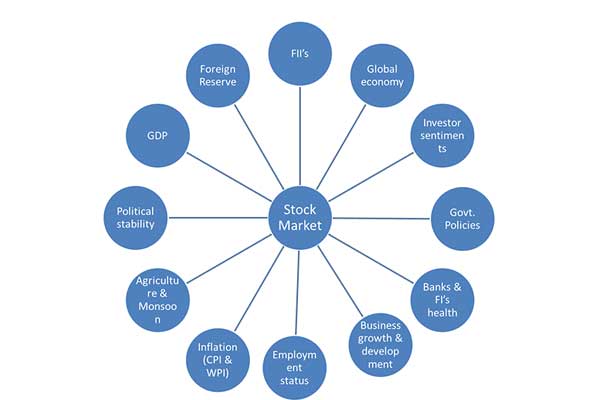

What are the factors that influence the price of a stock?

- The stock-specific factor is related to people’s expectations about the company, its future earnings, financial health and management, technology and marketing skills.

- Market specific depends on the environment rather than the performance of any particular company.

- Events favourable to an economy, political or regulatory environment like high economic growth, friendly budget, stable government etc. can attract investors, resulting in a boom in the market.

- On the other hand, unfavourable events like war, economic crisis, communal riots, minority government etc. depress the market irrespective of certain companies performing well.

-

What is Bid and Ask price?

Bid is the price at which the buyer is willing to purchase the securities. Ask is the price at which the seller is willing to sell the securities.

-

What is a Contract Note?

Contract note is the legal record of any transaction carried out on a stock exchange through a stock broker. It serves as the confirmation of trade done on a particular day on behalf of a client on a stock exchange (BSE/NSE). Usually, you receive this document from your broker at end of day if you have bought or sold share through him. A valid contract note should have following details in structured format:

- SEBI registration number of the Trading Member/ Sub broker

- Details of trade like, Order Number, Trade Number, Trade Price, Trade execution time, Traded quantity, Brokerage charged, Settlement reference number, Details of other service charges

- Signature of Authorized Signatory or Digital Signature in Electronic format

- Bylaws and regulations pertaining to Arbitration.

-

Why should one invest into Equities?

- Ownership & Voting Rights

- Capital Appreciation

- Dividend Income Exempt from Tax

-

What is a Portfolio?

A Portfolio is a combination of asset mix created for the purpose of achieving an investor's goal. The asset classes that can be considered as a part of your portfolio can include any asset such as:

- Shares - Investing in stocks/equity means that you will own a share of the company, in the form of share certificate. Generally, equity is considered as risky asset class and thus investment should be made for long term.

- Bonds - A bond is a formal contract to repay borrowed money with interest at fixed intervals i.e. either annually or semi ‐ annually.

- Mutual fund units - Mutual fund is an entity that pools money from large number of investors and invest in different securities. Some of the most popular types of funds are balance funds, growth funds, open end funds etc.

- Commodities - Commodities may be treated as a distinct asset class since their nature and behavior differs from other asset classes. These are basically materials that are sold in bulk, such as oil, wheat, gold, silver, pulses etc.

- Collectables - The traditional collectible investments include antiques, fine arts, or stamps etc, many of these collectibles are intended to be purchased as part of hobby or for other intangible purpose.

-

What is Diversification?

It is a risk management technique that creates a mix of investments within a portfolio to minimize the risk. It is designed to minimize the impact of any one security on overall portfolio performance.

What are the advantages of having a diversified portfolio?

A good investment portfolio is a correct mix of asset class. As different securities perform differently at any point in time, so with a mix of asset types, your entire portfolio does not suffer the impact of a decline of any asset class. When your stocks go down, you may still have the stability of the bonds in your portfolio. If you spread your investments across various types of assets and markets, you'll reduce the risk of your entire portfolio getting affected by the adverse returns of any single asset class.

Previous

Previous- Next

- /

- Take Test

-

Total Questions

10 -

Passing Marks

5 -

Total Time Allotted

Min -

Time Remaining

- Previous

- Next

- Submit Exam