-

What are Derivatives?

Derivatives are financial contracts that derive their value from an underlying asset. The underlying assets could be stocks, commodities, currencies, exchange rates or any other asset class. Generally, these financial instruments help you make profits by betting on the future value of the underlying asset. So, their value is derived from that of the underlying asset. This is why they are called derivatives.

For example, a wheat farmer may wish to sell their harvest at a future date to eliminate the risk of a change in prices by that date. Such a transaction is an example of a derivative. The price of this derivative is driven by the spot price of wheat which is the underlying. Mostly derivatives are used for hedging the risk which is associated with owning the underlying asset. In simple terms they are contracts for future delivery of assets and payment for them.

-

What are the different types of product available in derivatives?

There are four types of derivative contracts ‐ forwards, futures, options and swaps.

Forwards ‐ A forward contract is a contractual agreement between two parties to buy/sell the underlying asset. The exchange happens at a specific price on a specific future date. The price of the goods is fixed by both the parties on the day they enter into the agreement. In forward contracts are traded only in the OTC (Over the Counter) market, where individuals/ institutions trade through negotiations on a one to one basis.

Futures ‐ A futures contract is an agreement between two parties to buy or sell an asset at a specific time in the future for a pre determined price. These details are agreed upon when the transaction takes place. As futures contracts are standardized in terms of expiry dates and contract sizes, they can be freely traded on exchanges.

Options ‐ An option is a contract giving the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. They are two types of options contract ‐ the right to sell a security is called put option & the right to buy is called call option.

Swaps ‐ Swaps are private agreement between two parties to exchange the cash flows in the future based on the notional principal amount that both parties agree to.

-

Who are the participants in derivative market

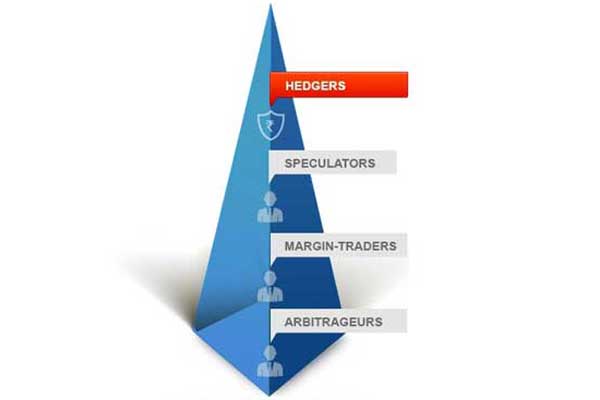

The participants into derivative market can be segregated into three categories ‐ hedgers, speculators and arbitrageurs:

Hedgers ‐ Traders, who wish to protect themselves from the risk involved in price movements, participate in the derivatives market. They are called hedgers. This is because they try to hedge the price of their assets by undertaking an exact opposite trade in the derivatives market. Thus, they pass on this risk to those who are willing to bear it. They are so keen to rid themselves of the uncertainty associated with price movements that they may even be ready to do so at a predetermined cost.

Speculators ‐ Speculators, unlike hedgers, look for opportunities to take on risk in the hope of making returns.

Arbitrageurs ‐ Derivative instruments are valued on the basis of the underlying asset’s value in the spot market. However, there are times when the price of a stock in the cash market is lower or higher than it should be, in comparison to its price in the derivatives market. Arbitrageurs exploit these imperfections and inefficiencies to their advantage. Arbitrage trade is a low-risk trade, where a simultaneous purchase of securities is done in one market and a corresponding sale is carried out in another market. These are done when the same securities are being quoted at different prices in two markets.

-

What is the structure of derivative market in India?

Derivative trading in India can take place either on a separate and independent derivative exchange or on a separate segment of an existing stock exchange. The exchange function as a Self-Regulatory Organization (SRO) and SEBI acts as the oversight regulator.

The clearing & settlement of all trades on the Derivative Exchange/Segment would have to be through a Clearing Corporation, which is independent in governance and membership from the derivative exchange.

Equity derivative market in India:

In India, equity based futures and options contracts are available on indices stocks. The various products available on the National Stock Exchange (NSE) for future and options trading are:

Products on derivative segment: Nifty 50 F&O Nifty IT F&O Nifty Bank F&O Nifty Midcap 50 F&O Nifty PSE Nifty Infrastructure Individual Securities

-

What are future contracts?

Futures Contract means a legally binding agreement to buy or sell the underlying security on a future date. Future contracts are the standardized contracts in terms of quantity, quality (in case of commodities), delivery time and place for settlement on any date in future. The contract expires on a pre-specified date which is called the expiry date of the contract. On expiry, futures can be settled by delivery of the underlying asset or cash. Cash settlement enables the settlement of obligations arising out of the future/option contract in cash.

-

Futures terminologies:

- Spot price ‐ The price at which the underlying asset is available for cash in the stock market. Based on the spot price of the security, the investors or traders are able to make projections about the future price movements of the security.

- Contract cycle ‐ As the contracts are standardized by the exchange, they will decide over what period the contracts will be available for trading. The index future contracts have near month, next month and far month.

- Expiry date ‐ It is the date before which the parties to the contract fulfil their contractual obligation. In equity derivative, contracts will expire on last Thursday of every month. As soon as the near month contract expires a new contract for the far month is available for trading.

- Contract / lot size ‐ In the cash market shares traded can be bought and sold in single units. In futures market as the minimum contract value for any derivative contract has to be Rs.500000 depending upon the current market price of an index, the stock exchange decides the minimum contract size which has to be brought / sold.

- Premium or Discount ‐ If the price in the futures market is more than the cash price of underlying asset then the futures contract is said to be trading at Premium. Similarly, if the price in the futures market is less than the cash price of underlying asset then the Futures contract is said to trading at Discount.

-

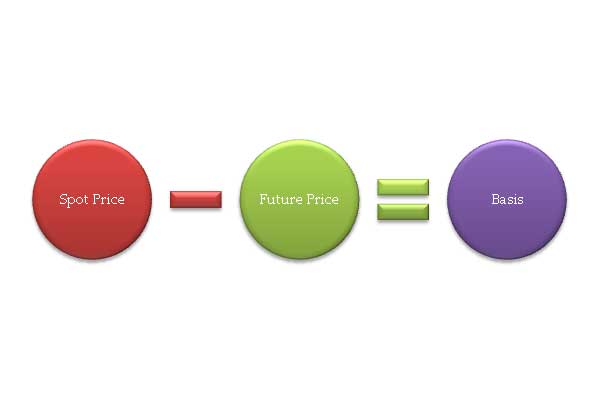

What is basis?

At a practical level, you will observe that there is usually a difference between the future price and spot price. The difference is called as basis.

- If the future price of an asset is trading higher than the spot price, then the basis for the asset is said to be negative. This means, the markets are expected to rise in future.

- On the other hand, if the spot price is higher than the future price, the basis for the asset is positive. This is indicative of a bear run on the markets in the future.

-

How to settle futures contract?

When you trade in futures contract, you do not give or take immediate delivery of the assets concerned. This is called setting of the contract. This usually happens on the date of the contract’s expiry. However, many traders also choose to settle before the expiry of the contract. For stock futures, contracts can be settled in two ways:

1 MTM settlement ‐

It is not necessary to hold on to a futures contract till its expiry date. In practice, most traders exit their contracts before their expiry dates. In case of futures contract, daily settlement is done on MTM basis (Mark to Market). Any gain or losses you’ve made are settled by adjusting them against the margins you have deposited till the date you decide to exit your contract. If the client is incurring losses, then it shall get adjusted initially to the initial margin of the position taken, and once the initial margin is exhausted, then the loss shall get adjusted to the free cash available in the trading account.

Here again, your profits will be returned to you or losses will be collected from you, after adjusting them for the margins that you have deposited once you square off your position.

-

How to settle futures contract?

2 Final settlement ‐

During final settlement, which happens during expiry, the spot price and the future price shall be same, as the cost of carry shall become zero, and settlement happens on spot price prevailing, the profit and loss so made will get adjusted with the ledger value of the trading account.

Example: Supposing you have purchased a single futures contract of ABC Ltd, consisting of 200 shares and expiring in the month of July. At that time, the share price was Rs. 1000. If on the last Thursday of July, ABC Ltd closes at a price of Rs. 1050 in the cash market; your future position will be settled at that price. You will receive a profit of Rs. 50 per share (the settlement price of Rs 1,050 less your cost price of Rs 1,000), which adds up to a neat little sum of Rs 10,000 (Rs 50 x 200 shares).

-

What are the margin pay offs on futures contract?

The main payoff for traders and investors in the derivative trading is margin payment. Margins are usually prescribed by the exchange as a percentage of the total value of the derivative contract. Without margins, an investor cannot buy or sell in the futures market.

- Initial margin ‐ Initial margin is defined as a percentage of your open position and is set for different positions by the exchange or clearing house. The factors that decide the amount of initial margin are the average volatility of the stock in concern over a specified period of time and the interest cost. Initial margin amounts fluctuate daily depending on the market value of your open positions.

- Exposure margin ‐ The exposure margin is set by the exchange to control volatility and excessive speculation in the futures markets. It is levied on the value of the contract that you buy or sell.

- Premium margin ‐ This is the amount you give to the seller for writing contracts. It is also usually mentioned in per-share basis. As a buyer, your pay a premium margin, while you receive one as a seller.

- Mark to market margin ‐ Mark-to-Market margin covers the difference between the cost of the contract and its closing price on the day the contract is purchased. Post purchase, MTM margin covers the daily differences in closing prices.

-

What are options contract?

An option is a derivative contract which gives the buyer of the contract the right, but not the obligation to buy/sell the underlying asset at a predetermined price within or at end of a specified period.

-

Parties to options contract:

- Buyer of an option ‐ The buyer of an option is the one who by paying the option premium buys the right but not the obligation to exercise his option on the seller.

- Seller of an option ‐ The seller of a call/put option is the one who receives the option premium and is thereby obliged to sell/buy the asset if the buyer exercises on him.

-

Options terminology:

When you are trading in the derivatives segment, you will come across many terms that may seem alien. Here are some Options-related jargons you should know about.

- Option premium ‐ The upfront payment made by the buyer to the seller of an option contract. Premium traded on exchange is for a single unit.

- Strike price/ exercise price ‐ The pre decided price at which the asset can be brought or sold.

- American and European Option ‐ The terms American and European refer to the type of underlying asset in an options contract and when it can be executed. American options are options that can be executed at any time on or before their expiration date. On the other hand, European options are options that can only be executed on the expiration date.

- Lot size ‐ Lot size refers to a fixed number of units of the underlying asset that form part of a single F&O contract. The standard lot size is different for each stock and is decided by the exchange on which the stock is traded. E.g. options contracts for Reliance Industries have a lot size of 500 shares per contract.

- Open Interest ‐ Open Interest refers to the total number of outstanding positions on a particular options contract across all participants in the market at any given point of time. Open Interest becomes nil past the expiration date for a particular contract.

-

Types of options:

Options are of two types ‐ call option and put option:

- Call option ‐ The Call Option gives the holder of the option the right to buy a particular asset at the strike price on or before the expiration date in return for a premium paid upfront to the seller. Call options usually become more valuable as the value of the underlying asset increases.

- Put option ‐ The Put Option gives the holder the right to sell a particular asset at the strike price anytime on or before the expiration date in return for a premium paid up front.

-

How are the options contract priced?

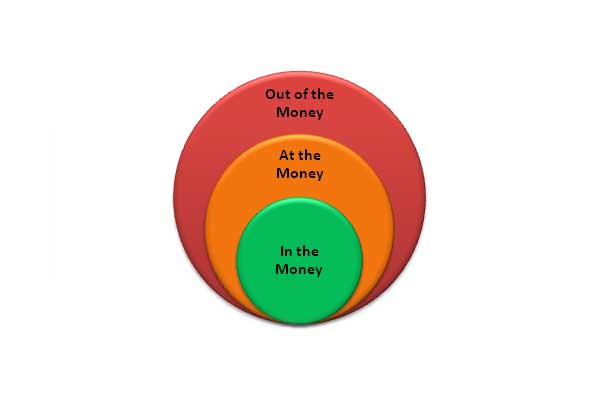

To understand how this premium amount is arrived at, we first need to understand some basic terms like In-The-Money, Out-Of-The-Money and At-The-Money.

- In-the-money ‐ An in the money option is an option that would lead to a positive cash flow to the holder if it were exercised immediately i.e. an investor will make profit by exercising the option. A call option is ‘in the money’ when the spot price of the asset is higher than the strike price. Conversely, a put option is ‘in the money’ when the spot price of the asset is lower than the strike price.

- Out-of-the-money ‐ An out of the money option is an option that would lead to negative cash flow if it were exercised immediately i.e. an investor will make no money by exercising the option. A call option is ‘out of the money’ when the spot price of the asset is less than the strike price. Whereas a put option is out of the money when the spot price is higher than strike price.

- At-the-money ‐ An at the money option is an option that would lead to zero cash flow if it were exercised immediately i.e. a no-profit, no-loss scenario if you choose to exercise the option. An option in the index is at the money when the spot price is equal to strike price.

-

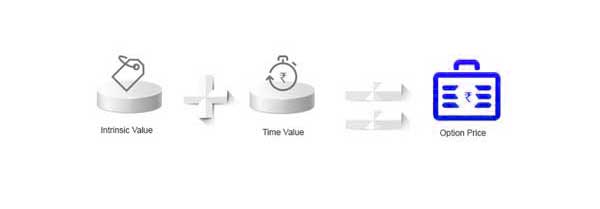

How is premium pricing arrived at?

The price of an option premium is controlled by two factors ‐ intrinsic value and time value of the option.

- Intrinsic value ‐ Intrinsic Value is the difference between the cash market spot price and the strike price of an option. It can either be positive (if you are in-the-money) or zero (if you are either at-the-money or out-of-the-money). An asset cannot have negative Intrinsic Value.

- Time value ‐ It basically puts a premium on the time left to exercise an options contract. For instance, if the time left between the current date and the expiration date of Contract A is longer than that of Contract B, Contract A has higher Time Value.

-

Difference between Futures and Options:

Futures Options Buyer is obligated to honour contract. No obligation on buyer to actually buy/sell. Contract seller has obligation to buy/sell if buyer exercises the right. Contract seller has obligation to buy/sell if buyer exercises the right. Requires higher margin payment than options. Requires lower margin payment than futures. Preferred by speculators and arbitrageurs. Preferred by hedgers. Unlimited profits, loss potential. Unlimited profits, limited loss potential.

-

Previous

Previous

-

Next

- /

- Take Test

-

Total Questions

10 -

Passing Marks

5 -

Total Time Allotted

Min -

Time Remaining

- Previous

- Next

- Submit Exam