-

What are Mutual Funds?

A mutual fund is an investment type that enables the investors to pool their money together in one professionally managed investment.

The primary role is to assist investors in earning an income or building their wealth, by participating in the opportunities available in various securities and markets.

To simply put, mutual fund can be considered as basket of investments. Each basket holds dozens or hundreds of security types, such as stocks or bonds. Therefore, when an investor buys a mutual fund, they are buying a basket of investment securities. However, it is also important to understand that the investor does not actually own the underlying securities the holdings but rather a representation of those securities; investors own shares of the mutual fund, not shares of the holdings.

-

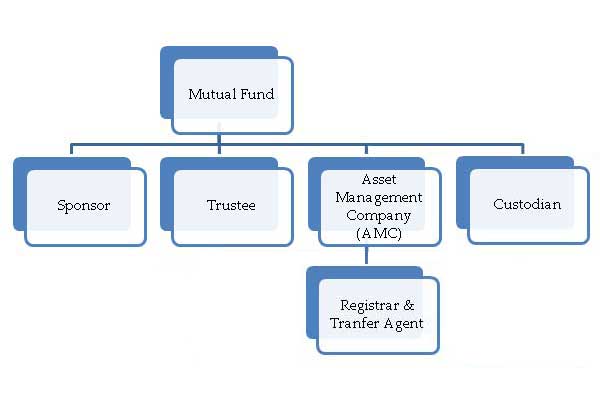

Structure of Mutual Fund:

The Mutual Funds in India are regulated by SEBI Mutual Fund Regulations, 1996. Under the regulations mutual fund is formed as a Public Trust under the Indian Trusts Act, 1882. Mutual fund in India follows a three tier structure:

-

Structure of Mutual Fund:

a. Sponsor

A mutual fund sponsor is basically promoter of the company i.e. any person who either itself or in association with another body corporate establishes a mutual fund. Not everyone can start a mutual fund, SEBI checks whether the person of integrity, whether he has enough experience in the financial sector. Once the SEBI is convinced, the sponsor creates a public trust.

b. Trustee

A mutual fund in India needs to be constituted in the form of trust. The trust is created through a document called trust deed which is executed by the fund sponsor in favour of trustees. They may be seen as an internal regulator of a mutual fund. Therefore, the role of protecting the investors is that of the trustees. Trustees have to appoint all key personnel like Fund Managers, Auditors, Custodian, Registrar, Compliance Officer Etc, and to inform the SEBI about same.

-

Structure of Mutual Fund:

c. Asset management company (AMC)

Trustees appoint the AMC, to manage investor’s money through an agreement called ‘Investment Management Agreement’. The AMC structures various schemes, launches the scheme and mobilizes initial amount, manages the funds and give services to the investors. The mutual fund pays a small fee to the AMC for the management of the funds.

d.Custodian

In Mutual funds, Asset Management Company buys different securities in the forms of Shares, bonds, gold etc. in different schemes. These Securities are bought in the name of Trust but they are not kept with the Trust. The responsibility of safe keeping the securities is on the custodian. They collect and account for the dividends and interest receivables on mutual fund investments. They also keep track of various corporate actions like bonus issue, rights issue, and stock split; buy back offers, open offer etc and act on these as per instructions of the Investment manager.

e. Registrar & Transfer Agents (RTA)

Mutual fund investors are spread across the country so it is not possible to provide these services to investors at all these places by Asset Management Company. Instead, they use entities called as Registrars and Transfer agents, which perform the important role of maintaining investor’s records. How many units will the investor get, at what price, what is the applicable NAV, how much money will he get in case of redemption, exit loads, etc is all taken care by the RTA.

-

Benefits of Mutual fund:

Portfolio management – Mutual funds are managed by experienced and skilled professionals, who with the help of an investment research team, analyze the performance and prospects of companies and selects suitable investments to achieve the objective of the scheme. It is a continuous process that takes time and expertise which will add value to your investments. Portfolio management can be a big help to an inexperienced investor who is looking to maximize their financial goals.

Diversification – Mutual funds invest in a wide range of securities. With diversification, an investor lowers the risk of loss by spreading your money across various securities. The cliché, "don't put all your eggs in one basket" really applies to the concept of smart investing Even if some investments in the scheme portfolio lose money, other investments in the portfolio can make up for the loss. This diversification through a mutual fund can be achieved with far less money i.e. with few thousand rupees in a mutual fund scheme, than you can do on your own.

-

Benefits of Mutual fund:

Economies of scale – Another advantage is the economies of scale, as a mutual fund buys and sells large amounts of securities at a time; its transaction costs are lower than what you as an individual would pay. The easiest way to understand economies of scale is by thinking about volume discounts in many stores, the more of one product you buy, the cheaper that product becomes. This also occurs in the purchase and sale of securities. If you buy only one security at a time, the transaction fees will be relatively large. Large investment corpus leads to various other economies of scale. Further, the higher transaction volume makes it possible to negotiate better terms with brokers, bankers and other service providers.

Liquidity – Mutual funds are typically very liquid investments i.e. it gives the advantage of buying and selling of funds with great ease. With open-end funds, you can redeem all or part of your investment any time you wish and receive the current value of the shares. Funds are more liquid than most investments in shares, deposits and bonds. Moreover, the process is standardized, making it quick and efficient so that you can get your cash in hand as soon as possible

-

Benefits of Mutual fund:

Tax benefits – Investments held by the investors for a period of 12 months or more qualify for capital gain tax and will be taxed accordingly.

Affordability – as a small investor may find that it is not possible to buy shares of larger corporations. Mutual funds generally buy and sell securities in large volumes which allow investors to benefit from lower trading costs. The smallest investor can get started on mutual funds because of the minimal investment requirements. You can start investing with a minimum of Rs. 500 in a SIP on regular basis.

-

Benefits of Mutual fund:

Rupee cost averaging – In case of mutual funds you invest a specific amount in regular intervals regardless of the investment unit price. It offers facilities that help investor invest regularly through a SIP or withdraw amounts regularly through a SWP, or move money through different kinds of schemes through STP. Rupee-cost averaging allows you to discipline yourself by investing every month or quarter rather than making sporadic investments.

Regulations – All mutual funds are required to register with SEBI. They are obligated to follow the rules and regulations designed to protect the investors. All the operations are regularly monitored by the SEBI, as the investors are benefited from such protection.

Transparency – Being under the regulatory framework, mutual funds have to disclose their investment pattern and all the information relating to the investment strategy, outlooks of the market and scheme related details to all investors frequently to ensure that transparency exists in the system.

-

Features of Mutual fund:

As discussed above benefits can be part of features, further nature of MF can be divided into two types:

A. Dividend option – Any investor who wants returns in periodical intervals will prefer this option. Investors opting for dividend option will get a payout in the form of dividend. This option will benefit the investors by moderate capital appreciation along with dividend returns over the period of holding. Dividend option is ideal for short term investment, especially in debt.

B. Growth option – In case of growth option, the money invested will continue to be reinvested until redeemed i.e. this will give you capital appreciation and returns, but not regular income. Since the fund does not payout any dividend the NAV is much higher than that of the dividend option for the same fund (this difference is only due to the payment of dividend and not due to the substantial variation in the fund performance). This type of investment is more long term investing.

-

NAV (Net asset value):

NAV refers to the price of a unit of the mutual fund, so help an investor keep a track record of the performance about the mutual fund. The Net Asset Value (NAV) of a mutual fund is the price at which units of a mutual fund are bought or sold. Similarly to how stocks have stock price, mutual funds have a Net Asset Value (NAV) and is calculated as follows:

NAV = (Market value of fund’s investments+ Receivables+ Accrued Income- outstanding Liabilities-Accrued Expenses)

-

Types of Mutual Funds:

Mutual funds can be classified into different categories, depending on they are structured and the nature of investments they make.

A. Fund Scheme:

Open ended fund – These funds are open for investors to enter or exit at any time, and do not have a fixed maturity period. Investors can buy and sell units at NAV related prices, which are declared on daily basis. Open ended funds are preferred for their liquidity and are not listed on any exchange. Such funds can issue and redeem units any time during the life of a scheme. Hence, unit capital of open-ended funds can fluctuate on a daily basis.

Close ended fund – A closed ended scheme has a stipulated maturity period. Investors can invest in the scheme at the time of initial public issue, after that you can buy or sell already issued units of the scheme listed on the exchange. The market price of the units could vary from the NAV of the scheme due to demand and supply factors, investors' expectations and other market factors.

-

Types of Mutual Funds:

B. Based on Assets Invested in:

Equity funds – These are the funds that invest only in stock. Equity funds aim to grow faster than money market and fixed interest instruments. As a result, they are usually considered high risk, high return funds. These funds have less tax liability in long run as compared to debt funds.

Debt funds – These funds invest in debt market instruments like bonds, government securities, debentures and so on. Debt funds are usually preferred for the regular interest payments. In case of debt instruments are considered relatively safer, interest payments are fixed as well as the return of the principle amount, thus, they are considered low-risk, low-return financial assets.

Hybrid funds – These funds invest in both equities and debt instruments. Hybrid funds are less risky than equity, but more than debt funds.

-

Types of Mutual Funds:

C. Based on Investment Objectives:

Growth funds - These are schemes that promise capital returns in the long-term. Growth fund schemes are usually high risk schemes, as mostly they are invested in equities. In case of growth funds, reinvest the dividends money into increasing the assets under management.

Income funds – These funds promise to pay regular income for a period of time. For this reason, fixed-income funds are usually a kind of debt fund. This makes fixed-income funds low-risk schemes, which are unlikely to give you a large amount of profit in the long-run. They pay higher dividends than growth funds. As with debt funds, they may be further classified on the basis of the specific assets invested in or on the basis of maturity.

Balanced funds – These funds try to strike a balance between risk and return. They do so by investing in both equities and debt instruments. As a result, they are a kind of hybrid fund. Their risk is lower than equity or growth funds, but higher than debt or fixed-income funds.

-

Types of Mutual Funds:

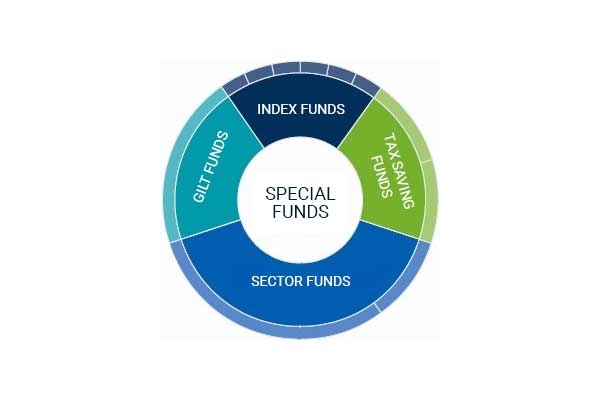

D. Special funds:

Index funds - Indices serve as a benchmark to measure the performance of the market as a whole. Indices are also formed to monitor performance of companies in a specific sector.

Tax saving funds - Investors is now encouraged to invest in the equity markets through the Equity Linked Savings Scheme (ELSS) by offering them a tax rebate. When you invest in such schemes, your total taxable income falls.

Sector funds - These kind of equity scheme restrict their investing to one or more pre-defined sectors, e.g. IT, Banking sector. Since they depend upon the performance of select sectors only, these schemes are inherently more risky than general schemes. They are best suited for informed investors, who wish to bet on a single sector.

Gilt funds – These schemes primarily invest in government securities, which do not have credit-risk i.e. the risk that the issuer of the security defaults. There is no risk of default and liquidity is considerably higher in case of government securities.

-

Scheme selection:

The selection of a scheme for a mutual fund will depend upon the need that the investor has from the investment. Mutual funds are a vehicle that helps an investor take exposure to different asset classes, like equity, debt, gold etc. Selecting a scheme is more or less like doing a financial plan; you need to select a fund that best suits your needs i.e. income schemes, liquid schemes or tax savings schemes, equity schemes, etc.

-

Scheme selection:

a. Investment objective – The first step to investing in mutual fund is to define the objective of investing i.e. why we are investing? Based on your investment objective, an investor might take on additional risk. For instance, a retiree might prefer an investment whose chief benefit is the periodic income payments it offers. On the other hand, few investors might want to preserve the value of original investment. Thus, your investment objective will determine the role a specific fund will play in your portfolio and how well it might fit with your overall investing strategy.

b. Time horizon – Investment time horizon are determined by an investor’s goals for the funds rather than the mechanism itself. The general rule is, the longer your time horizon, the more high yielding investments you can make i.e. you have more opportunity to ride out fluctuations in your investments. On the other hand, if your time horizon is very short, you may want to concentrate your investments that may offer a lower return.

-

Scheme selection:

c. Prioritizing your goals – Goals allows you to bucket your money according to individual financial needs and desires. Taking time to consider what you want to achieve as a result of your investment process will guide you in determining specific investment goals. For example, you might try to set up your portfolio so that it averages a certain percentage return over time, or so that it produces a given level of income.

d. Liquidity requirements - Liquidity refers to how quickly an investment can be converted into cash. Your liquidity needs will affect the type of investment you might choose to meet your goals. For example, if you don’t have short term liquidity needs, you can probably afford to invest in less liquid investments where the potential for gain is much higher than for more liquid investments.

-

Scheme selection:

e. Scheme type – The investor’s need from the investment will determine the fund that is most suitable. Each scheme has a different risk and return characteristics. For instance, an investor looking for growth will find equity oriented funds to best suit his needs. Whereas an investor who wants regular income will look at debt fund or dividend investment.

f. Fund performance – The fund’s performance is primary criterion in its selection from amongst the others. The return that the fund has generated relative to its benchmark should ideally have outperformed the benchmark. Usually the performance of the scheme is seen for a period of 3 to 5 years based on the nature of the fund.

-

Risk Profiling:

To fulfil any investment objective the investor should first evaluate their risk profile. As we know, all investment carry different level of risk, similarly, there is also difference between the level of risk the investor thinks they are comfortable with, and the level of risk they ought to be comfortable with. Risk profiling is a process for finding out finding the optimal level of investment risk an investor is willing to take considering the risk appetite.

Risk appetite is an important factor while choosing the mutual funds scheme that fits investor goals of growth, stability and timeframe. For instance, a conservative investor’s primary objective is to preserve the capital, whereas a moderate investor is willing to take controlled risk for moderate returns. On the other hand, an aggressive investor considers risk as an opportunity.

- Current scenario – your risk appetite can increase or decrease depending upon your age, financial dependents, assets and liabilities, sources of income and investible capital.

- Investment experience – your level of investing experience must also be considered while determining your risk profile. Knowledge about investment product, nature and composition of the last held portfolio and its performance.

- Future outlook – what is the time horizon available to fulfil your investment objective, liquidity requirements in near future, tax savings and returns on investment etc, should also be considered.

- Investment attitude - Different investments carry different levels of risk. All investments involve a degree of risk and returns can never be guaranteed so it is important to choose investments that suit your circumstances i.e. willingness towards risk taking and ability to withstand short-term notional losses in return for long-term high returns.

-

Taxation

Since the returns on the mutual funds are passed through the investors, the returns are taxed in the hands of investors in the form of capital gains. The returns from mutual fund can either be in the form of dividend or capital appreciation, the tax liability will depend upon the type of mutual fund scheme you choose and the period of holding the investment.

a. Tax on equity oriented mutual funds –

In case of equity oriented mutual funds have no tax on long term capital gains i.e. if you hold the fund for more than 12 months from the date of purchase; is exempted from paying tax. On the other hand, if the fund is held for a short term period i.e. less than 12 months, the capital gain tax of flat at the rate of 15% is levied his investment.b. Tax on debt oriented mutual funds –

In case of debt mutual funds both short term and long term gains are taxed. Short term capital gains are added to the income and taxed as per the individual’s income slab rates. Whereas long term capital gains from debt mutual funds are taxed at 20% with indexation and 10% without indexation. Dividends are tax free.c. Dividend Distribution Tax (DDT) – Dividends are tax free in the hands of investor free. However, there is DDT applicable for dividend distributed by debt mutual fund schemes. The high DDT (works out to be 28.32% now) has taken the sheen out of the dividend options in debt mutual funds.

Capital Gains Short term Long term Equity 15% + surcharge +cess NIL Debt & Liquid funds As per slab rate + surcharge + cess 10% without indexation; 20% with indexation

-

How to apply for a Mutual Fund Scheme?

Mutual fund requires as much as strategic input as any other investment option and all these funds are categorized based on the underlying securities held by the fund. Risk is an important consideration when evaluating mutual funds. As an investor, you should choose a mutual fund that meets your needs and risk capacity levels.

Before investing into any scheme, an investor has to be comfortable with AMC. Different asset management companies have different approaches, styles and value systems in doing business. Note that an investor buying into a scheme is essentially buying into its portfolio. Investors can also contact the agents and distributors of mutual funds who are spread all over the country for necessary information and application forms.

An investor can invest in mutual through various channels; it can be either through online or offline mode:

-

How to apply for a Mutual Fund Scheme?

1. Asset management company website

Most fund companies offer the facility to transact in mutual funds online. You first download the scheme form from the website, fill in your details and submit the same along with the initial cheque, photocopy of PAN card (Permanent Account Number) and KYC (Know Your Customer) letter. You also need to apply for a personal identification number (PIN) for online transactions. Once you are assigned a folio number along with the PIN, all subsequent transactions in the folio can be done online using your bank account. However, you need to go through the entire procedure again if you also want to invest in other fund houses. This is the cheapest route for the investor because the facility comes absolutely free. The flip side is remembering 6-7 different PINs for various fund houses; which can be a big headache

-

How to apply for a Mutual Fund Scheme?

2. Brokers

Most large brokers are today linked to the NSE or BSE mutual fund exchange platforms. All you have to do is log on to the broker's online trading terminal and select the scheme of your choice from the list of schemes available on the portal. The units will be credited directly to your demat account. You can do an SIP or a lump sum investment as per your wish. The charges are nominal; however they vary from broker to broker. On the other hand, for those who do not have a demat account, setting one up with a broker will involve various charges such as account opening charge, annual maintenance charges, etc.

-

How to apply for a Mutual Fund Scheme?

3. Independent portals

There are independent portals like Fundsindia, Scripbox, and Fundsupermart etc; which came into existence in 2009 and have been catering to mutual funds investors to buy and sell online at no extra cost. All you have to do is open an account with them, fill up a form online, take a printout of this pre-filled online form, sign it, attach a copy of your PAN card and KYC acknowledgement and send to them. Once this is done, you can buy MFs across 41 fund houses.

Sno Offline Online 1 Contact a distributor or agent of mutual funds. Visit the website and register for online transaction services. Provide necessary information i.e. Folio Number, email id and mobile registered with the folio etc. 2 Get the application form. The F-Pin will be generated and will be sent to you in email id and on mobile registered with that folio. 3 Fill an application form providing necessary information i.e. Name, Address, PAN, email id, mobile number etc. Using this F-Pin you can create your User ID and Password. 4 Attach copies of relevant documents and submit it along with a cheque or demand draft for the amount of investment. Login using the credentials just created and start investing. 5 If applied through an agent or distributor, they would submit the application form with the cheque and all relevant documents to the mutual fund company. 6 The mutual fund company then would allocate you with a folio number for the particular investment and would issue you an Account Statement.

Previous

Previous- Next

- /

- Take Test

-

Total Questions

10 -

Passing Marks

5 -

Total Time Allotted

Min -

Time Remaining

- Previous

- Next

- Submit Exam