-

About Forex markets

The foreign exchange market (Forex market, FX) is where currency trading takes place. Presently, the forex market is one of the largest and most liquid financial markets in the world and includes trading between large banks, central banks, currency speculators, corporations, governments and other financial institutions.

We often come across the terms like base currency and term currency in forex markets. The base currency is the first currency in a currency pair. The second currency is called as the term or pair currency. Exchange rates are quoted in per unit of the base currency. Eg: the expression Dollar- Rupee, tells you that the dollar is being quoted in terms of rupee. The Dollar is the base currency and Rupee is the term currency.

The changes in the currency expresses the strengthening or weakening of respective currency Vis a Vis the second currency. Whenever the base currency buys more of the terms currency, the base currency has strengthened/ appreciated and the term currency has weakened/ depreciated. Example: if the dollar – Rupee moved from 43.00 to 43.25, it signifies that the Dollar has appreciated and the rupee has depreciated.

-

Currency Derivatives in India

Currency derivatives are a contract between the seller and buyer, whose value is to be derived from the underlying asset i.e. the currency value. A currency derivative is based on agreement that two currencies may be exchanged at a future date at a specified rate. The underlying asset in a currency derivative –

In India, currently currency contracts are permitted on four currency pair’s i.e. USDINR, EUROINR, GBPINR and JPYINR

Futures Options US Dollar/INR Only in USD/INR Euro/INR Yen/INR UK Pound/INR

-

Regulatory body that governs Currency Derivative in India

The Exchange Traded Currency Derivative market is regulated by SEBI through the recognized stock exchanges. The Foreign Exchange Management Act is the law, which regulates the Foreign Exchange market and the regulatory authority for the Indian Foreign Exchange Market is the Reserve Bank of India (RBI).

The commonly used exchanges on the national level are – Multi Commodity Exchange (MCX- SX) National Stock Exchange (NSE) Bombay Stock Exchange (BSE) and USE.

-

Currency Derivative Instrument

(A) Currency Futures

- A futures contract is a standardized contract, traded on an exchange, to buy or sell a certain underlying asset or an instrument at a certain date in the future, at a specified price.

- When the underlying value is an exchange rate, the contract is termed as currency futures contract.

- Currency futures are exchange-traded contracts and they are standardized in terms of delivery date, amount and contract terms.

- These contracts allow investors to hedge against foreign exchange risk. Since these contracts are marked-to-market daily, investors can by closing out their position and exit from their obligation to buy or sell the currency prior to the contract's delivery date.

(B) Currency Options

- A currency option allows the buyer the right but not the obligation to buy or sell the underlying at a stated date and at a stated price.

- For this right the buyer pays premium to the seller of the option. The premium is quoted in rupee terms; however the outstanding position is in USD terms.

- A call option gives the right to buy and put option gives the right to sell.

- The underlying value for currency option shall be USD INR spot rate.

- Options contract were introduced in the Indian markets in October 2010.

-

Advantages of Currency Derivative:

- Hedging – Hedging basically refers to reducing the risk of price movements in an asset. In case of currency derivatives, you can protect your foreign exchange exposure but also hedge potential losses by taking necessary positions for the same. For example, you would hedge if you were of the view that USDINR was going to depreciate.

- Speculation – You can speculate on the short term movement of the markets by using currency futures. For e.g. If you expect that oil prices would rise in the future, accordingly you could buy USDINR in expectation that the INR rate would depreciate.

- Leverage – In case of currency derivatives you can trade by just paying a % value called the margin amount instead of the full traded value.

- Arbitrage – This refers to the process of purchasing and selling the same security; at the same time in different markets. This is done to take the advantage of price difference between the two separate markets.

-

Factors affecting exchange rate of currency

- Inflation – Changes in market inflation cause changes in currency exchange rates. For instance, a country with a lower inflation rate than another will see an appreciation in the value of its currency while a country with higher inflation typically sees depreciation in its currency and is usually accompanied by higher interest rates.

- Interest rates – An increase in interest rate will cause the currency value to appreciate because higher interest provides higher interest rate to lenders, thereby attracting more foreign capital which causes a rise in currency rates.

- Recession - When a country experiences a recession, its interest rates are likely to fall, decreasing its chances to acquire foreign capital. As a result, its currency weakens in comparison to that of other countries, therefore lowering the exchange rate.

- Trade terms – The trade terms shows the ratio of export and import prices. For instance, a country's terms of trade improves if its exports prices rise at a greater rate than its imports prices. This results in higher revenue, which causes a higher demand for the country's currency and an increase in its currency's value. This results in an appreciation of exchange rate.

- Government debt – A country with government debt is likely to acquire foreign capital, leading to inflation. In such case, the foreign investors will sell their bonds in the open market if the market predicts government debt within a certain country. As a result, a decrease in the value of its exchange rate will follow.

-

Currency Trading

All the currency derivatives are traded in pairs like Rupee – Dollar etc. Let’s say that a trader buys a dollar derivative contract at the rate of 66.5900, then the contract value with the lot size of 1000, becomes Rs. 66590. Suppose during the course of trade, if the dollar rate moves from 66.5901, then the contract value will jump to Rs. 66590.10. Hence, the upward and downward movement results in the gain or loss for the trader.

-

How currency contracts are settled?

All the currency – future and options contracts are cash settled.

How many contracts are available?

It means the period for which the contract will be available for trading. The currency future contracts are available for trading for all maturities from 1 to 12 months.

-

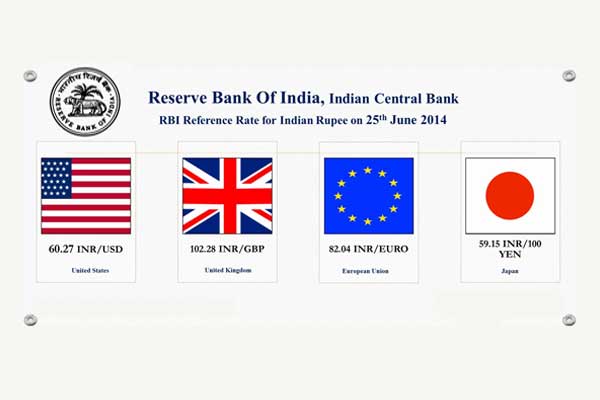

RBI Daily Reference rate

The RBI complies on daily basis and publishes a reference rate for spot USDINR and spot EURINR. The rates are arrived at by averaging the mean of the bid/offer rates polled from a few select banks around 12:30 noon every day. For example, the RBI’s reference rate for US Dollar is Rs. 66.6322 as on October 6, 2016.

-

What is a lot size?

There are fixed lot sizes defined by the exchange. In case of currency derivatives, you will have to trade in minimum 1000 qty which is equal to 1 lot size in respective currency pairs (i.e. 1 lot = 1000 qty). So if USDINR price is Rs. 66, you will have to trade in minimum 1 lot which is 1000 USD. Hence you will be buying 1000 USD or multiple of that on the currency pair.

Size of Contract (One Lot) USDINR EURINR GBPINR JPYINR Minimum Lot Size is US$ 1,000 Minimum Lot Size is EURO 1,000 Minimum Lot Size is GBP 1,000 Minimum Lot Size is YEN 1,00,000

-

Currency Derivative Settlement cycle?

In case of currency derivatives the trade timings are – Monday to Friday – 9:00 am to 5:00 pm.

- Daily settlement – The currency future contracts position for each member is marketed to market (MTM) to daily settlement price of the future contract at the end of each day. The profit/loss is computed as the difference between the trade price and the current day’s settlement price. The pay in and pay out of MTM settlement is on T+1 day.

- Final settlement - The final settlement profit / loss is computed as the difference between trade price and the RBI reference rate of such futures contract on the last trading day at 12:30 noon. Final settlement loss/ profit amount is debited/ credited to the relevant CMs clearing bank account on T+2 day.

-

Final Settlement Price

Final settlement price for a futures contract for the various currencies shall be as mentioned below, or as may be specified by the relevant authority from time to time.

USDINR EURINR GBPINR JPYINR Final settlement price RBI reference rate RBI reference rate Exchange rate published by RBI in its Press Release captioned RBI reference Rate for US$ and Euro. Exchange rate published by RBI in its Press Release captioned RBI reference Rate for US$ and Euro. The detail of these contract designs of these currency pair’s is given below:

Underlying USDINR EURINR GBPINR JPYINR Trading Hours 9:00 AM to 5:00 PM Size of Contract (One Lot) Minimum Lot Size is US$ 1,000 Minimum Lot Size is EURO 1,000 Minimum Lot Size is GBP 1,000 Minimum Lot Size is YEN 1,00,000 Price Quotation Rs per USD Rs per EURO Rs per GBP Rs per 100 YEN Tenor of Contract Maximum of 12 Months Available contract Monthly, Quarterly Last Trading Day 2 Working Days prior to the last business day of the Expiry Month Final settlement day Last working day of month, except Saturday Options USD INR Lot size 1000

-

Money Margin required:

- The currency pairs are available to traders at a margin which means they pay only some per cent value of the contract, rather than the full value, making it a lucrative trading option among the traders.

- The margins for these contracts are decided by brokers based on exchange guidelines. On an average, traders can buy the contracts by paying a margin of 3-5 per cent of the total value of the contract size.

- The prescribed level of minimum margin required for different currency pair is given below:

USDINR EURINR GBPINR JPYINR Minimum margin required 1.75% 2.8% 3.2% 4.5% For instance, indicative margin required for currency futures is given below:

Exchange Contract Total NSE CDS USDINROCT 1,373 NSE CDS USDINROCT 1,872 NSE CDS USDINROCT 2,649 NSE CDS USDINROCT 1,949

-

Expiry date/Last trading date

It is the date specified in the futures contract. All contracts expire on the last working day (excluding Saturdays) of the contract months. The last day for the trading of the contract shall be two working days prior to the final settlement date or value date. Let’s say, if the last date of the month falls on Friday then Wednesday will be considered as last trading day.

Previous

Previous- Next

- /

- Take Test

-

Total Questions

10 -

Passing Marks

5 -

Total Time Allotted

Min -

Time Remaining

-

Total Questions

10 -

Passing Marks

5 -

Total Time Allotted

Min -

Time Remaining

- Previous

- Next

- Submit Exam